Disney claims it didn't acquire any liabilites-but both the Fox and Lucasfilm acquisitions were stock acquisitions, meaning that acquired companies inclusive of all assets and liabilities. Something is off with how both sides are characterizing the agreements. ) Given Fox's history of non-standard/talent-friendly legal practices during the era in question (see, e.g., letting Lucas keep the rights to Star Wars), that sounds like something that 80's era Fox would have done.with respect to the Aliens novelizations.

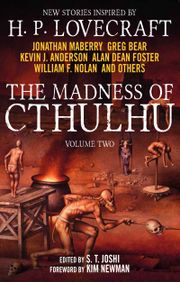

Interestingly, ADF is claiming that the payments are royalties. It is extremely rare for commissioned works to be subject to royalties, and that generally involves novelizations. To the extent the author might receive any ongoing payments, those would generally be "performance bonuses" for reaching milestone sales. As a WFH, the commissioning employer would own the copyrights, and an author would not be entitled to royalties because they aren't licensing a copyright from them. Generally, a novelization of a preexisting script (such as all of the novels that ADF is complaining about) is a "commissioned" work, meaning that it is a WFH under American law. This is a good resource about WFH in general. Unfortunately it's just too expensive a solution to justify itself for us proles. The evidence that this is the status-quo is that it exists, and has not, to date, been "solved" by any one government. Most of these tricks involve entities-in-cahoots across multiple (usually at least three) jurisdictions, so I imagine it might take quite a LONG time before the various legal authorities in all relevant jurisdictions get sufficiently coordinated to have effective regulations in place. That's the stuff a Tax-Haven-As-Service outfit would have to solve behind the scenes. In my experience the 0.01% are privileged to play by the book, but have an advantage over the rest of us in having access to a whole library of books to choose from, and the money to hire experts in book-selection and lackeys to manage the whole affair on a day-to-day basis. I don't think it's solely/mainly a question of volumes/numbers and being sufficiently well connected, though no doubt it is a factor. Jersey (pop 97,000) and Guernsey (pop 67,000) more assets than Romania (pop 19,000,000)? Seems legit. Nearly a trillion Euro sitting in the Cayman Islands? Bank soundness "n/a"? Seems legit.

Look down and do a rough division of size of assets by size of country, and you can estimate which countries have the biggest tax avoidance industries. Lots of the Crown Dependencies and Overseas Territories make their livings from tax avoidance the Paradise Papers caught out a lot of celebrities using their services. This happened in the UK: it was very common for IT contractors to set up companies to get preferential tax rates, until the "IR35" reforms targeted that. Once everyone starts bending the rules the rules bend back. The 0.1% get their privileges by being small in number and well-connected enough to deal with legislative retaliation. Like most "exploits as a service", this only works if your volume is small enough to not make it worth shutting you down.

0 kommentar(er)

0 kommentar(er)